pay indiana state property taxes online

In California for instance HOAs typically dont pay property taxes though there may be other district taxes such as parcel taxes and library taxes. All 92 counties in the Hoosier State also charge local taxes.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Learn Indiana income property and sale tax rates so that you can estimate how much you will pay on your 2021 taxes.

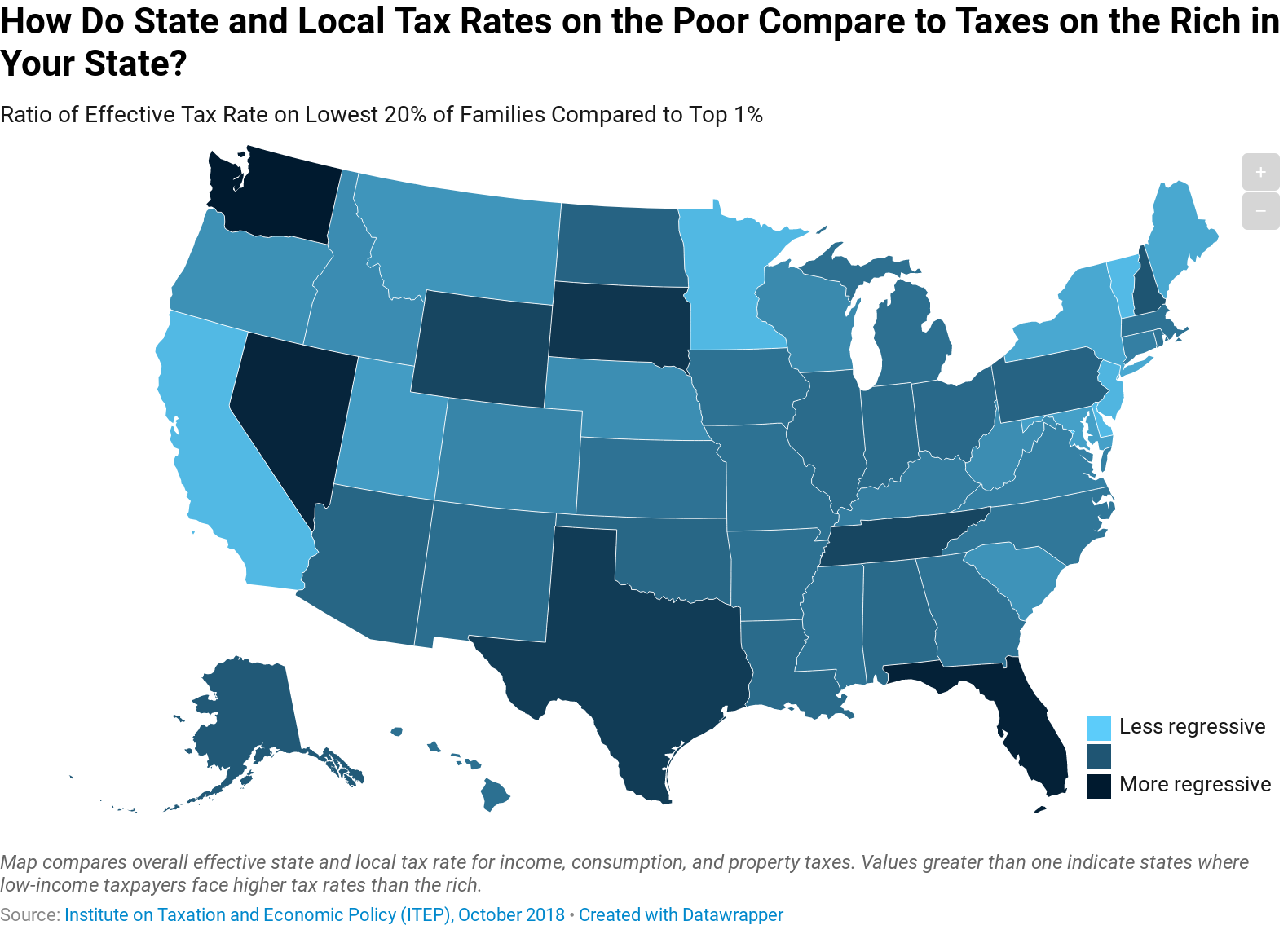

. Another deduction you can take on your federal return to try to nip away at your tax bill is for the income taxes you must pay to your state on your winnings. Property taxes or real estate taxes are paid by a real estate owner to county or local tax authoritiesThe amount is based on the assessed value of your home and vary depending on your states property tax rateMost US. Unfortunately the Tax Cuts and Jobs Act limits this itemized deduction to 10000 for tax years 2018 through 2025 and to just 5000 if youre married and filing a separate return.

For instance Louisiana currently has the fifth-lowest property tax rate in the US. Take the renters deduction. Do condo associations pay property taxes.

The Personal Property Division information page of the SDAT Web site contains links to forms and instructions brochures exemptions tax rate charts and more. Pay my tax bill in installments. These local taxes could bring your total Indiana income tax rate to over 600 depending on where you live.

The credit for taxes paid to another state section will be at the end of your residence states interview process. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Generally condo associations pay property taxes of the common areas.

Homeowners have to pay these fees usually on a monthly basis in combination with their mortgage payments. Different states also have varying laws when it comes to property taxes. Please note that you will only get a tax credit for your IL state income taxes up to the amount of IN state income taxes that would have been paid if the income was earned in IN.

Claim a gambling loss on my Indiana return. Find Indiana tax forms. If you received a civil service pension nonmilitary and are at least 62 years of age then you may be eligible for up to a 16000 deductionBeginning with tax year 2015 a surviving spouse no minimum age requirement may be eligible to claim the deduction.

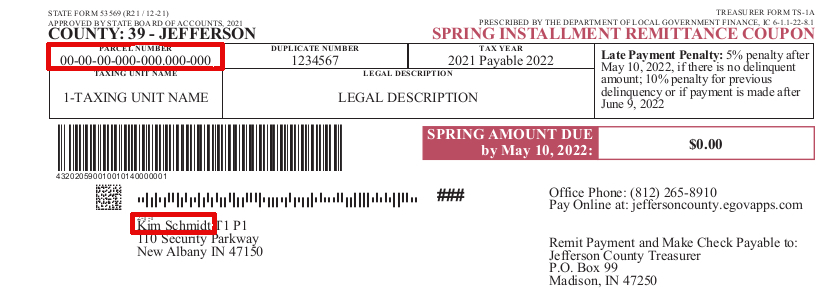

X Select State Public. Search Decatur County property tax records or pay property taxes online by. Overview of Indiana Taxes.

Explore our list below to see the 10 states with the lowest property taxes by their average effective property tax rate. Search Assessor and Property Tax Records Records in Indiana. Know when I will receive my tax refund.

Personal property generally includes furniture fixtures office and industrial equipment machinery tools supplies inventory and any other property not classified as real property. Indiana state income tax rate is 323. Indiana has a flat tax rate meaning youre taxed at the same 323 rate regardless of your income level or filing status.

Have more time to file my taxes and I think I will owe the Department. And at 4 it also has one of the lowest sales taxes in the country as well while its state income taxes range between 2 and 6.

2022 Property Taxes By State Report Propertyshark

How To Read Your Property Tax Bill Community Development

Property Tax How To Calculate Local Considerations

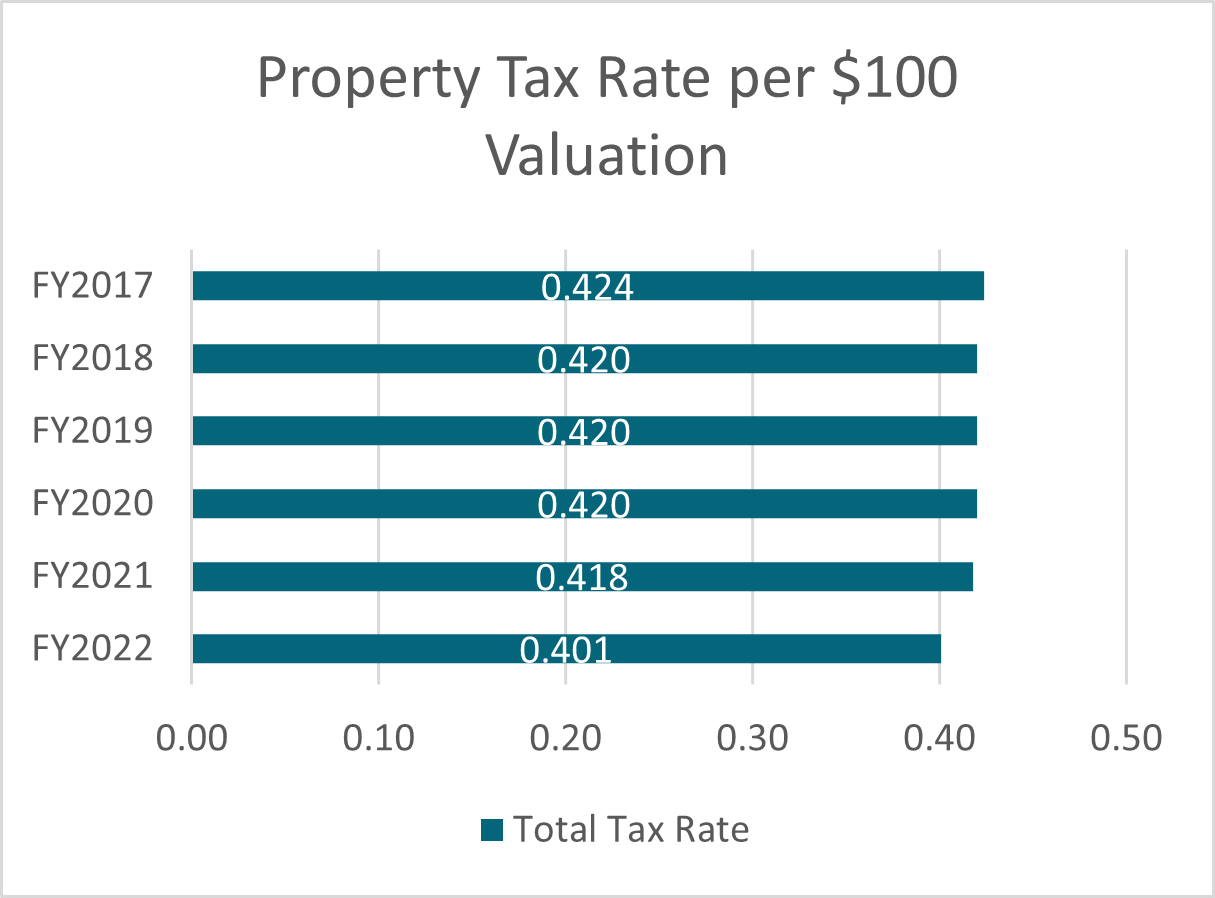

Property Taxes Georgetown Finance Department

Orange County Ca Property Tax Calculator Smartasset

Deducting Property Taxes H R Block

How Taxes On Property Owned In Another State Work For 2022

Pennsylvania Property Tax H R Block

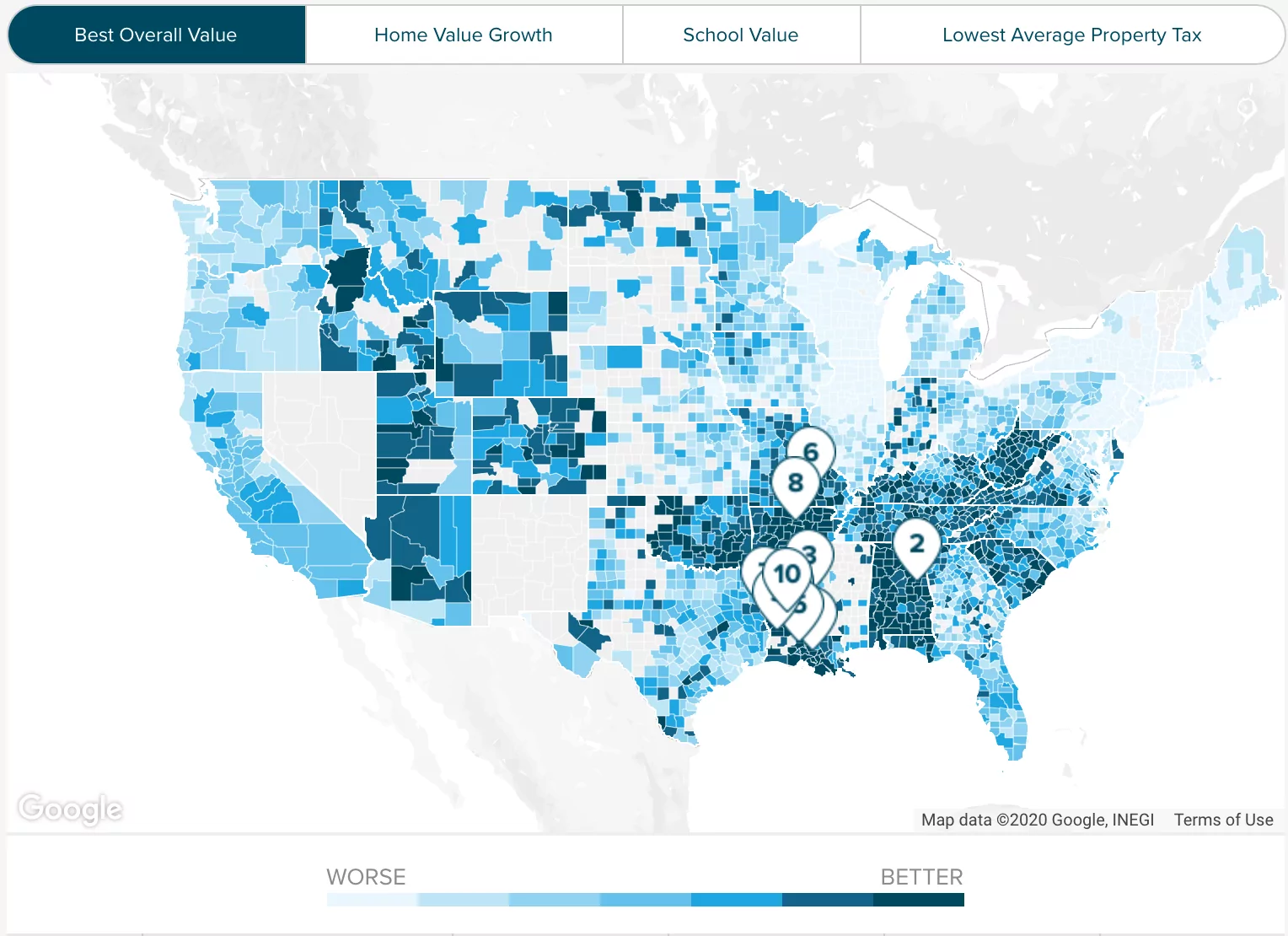

Property Tax By State Ranking The Lowest To Highest

Property Taxes How Much Are They In Different States Across The Us

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Ricevimenti Valutazione

Property Taxes By State Embrace Higher Property Taxes

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)