tax on unrealized gains crypto

Including Profit Loss calculations Unrealized Gains and a Tax-Report for all your Coins. The clause would change a tax law one Nashville couple has been fighting for over a year.

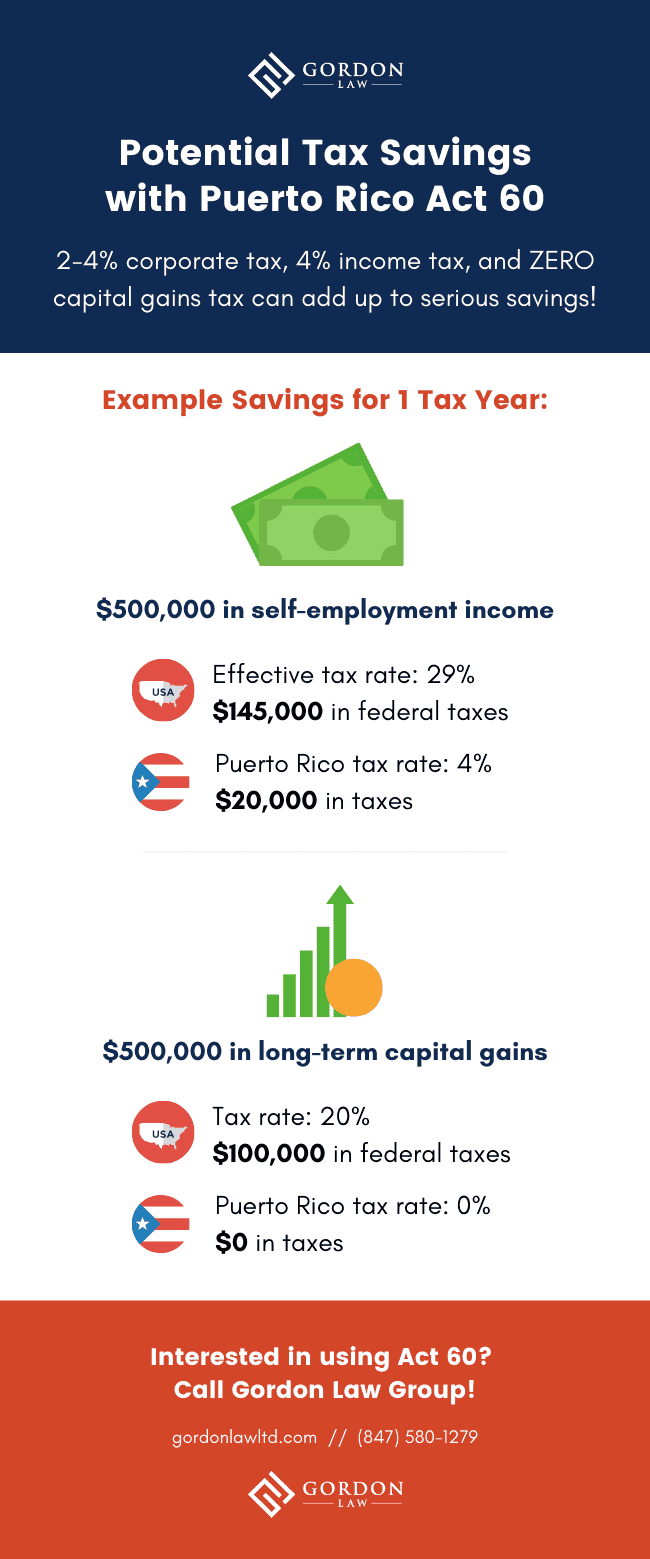

Crypto Tax Unrealized Gains Explained Koinly

The Bitcoin Net Unrealized ProfitLoss shows that the Bitcoin bottom is in.

. Federal government by deliberately selling an investment at a lossie deliberately taking a capital lossin. In May 2021 Joshua and Jessica Jarrett requested a refund of 3293 of income tax paid in 2019 for the receipt of 8876 Tezos tokens according to a legal complaint filed on May 26 2021 with the US District Court for the Middle District of Tennessee. It has been implemented with a new algorithm that enables the system to support accurate NFT tax calculations.

In this guide. Use your trading history to calculate your realized and unrealized gains and track your cost basis all through this software. Capital gains report Download your capital gains report which shows your short and long term gains separately.

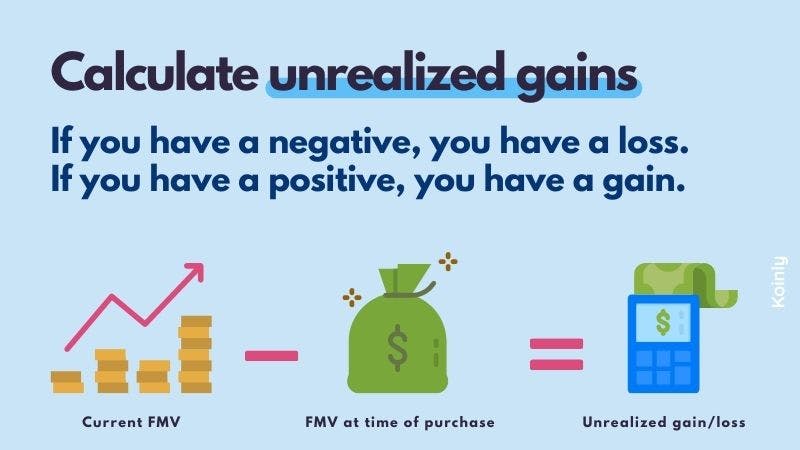

Top 12 best blockchain play-to-earn. CoinTracking Portfolio Management and Cryptocurrency Tax Report for Bitcoin and all Coins. Youve made a profit of R10000 at this stage but its an unrealized profit because you dont profit until your trade is terminated.

CoinTracking analyzes your trades and generates real-time reports on profit and loss the value of your coins realized and unrealized gains reports for taxes and much more. Crypto tax platform Koinly takes a closer lookSydney June 29 2022 GLOBE NEWSWIRE -- Tax-loss harvesting allows you to claim capital losses by recognising and selling your assets at a loss. BTC dropped to below 18k.

Tax-free thresholds on your capital gains can help you automatically owe less. The recent volatility across the crypto market has led to Bitcoin dropping to 2020 levels. Capital Gains tax is a form of income tax accumulated after making profit from assets bought at a cheaper price and sold at.

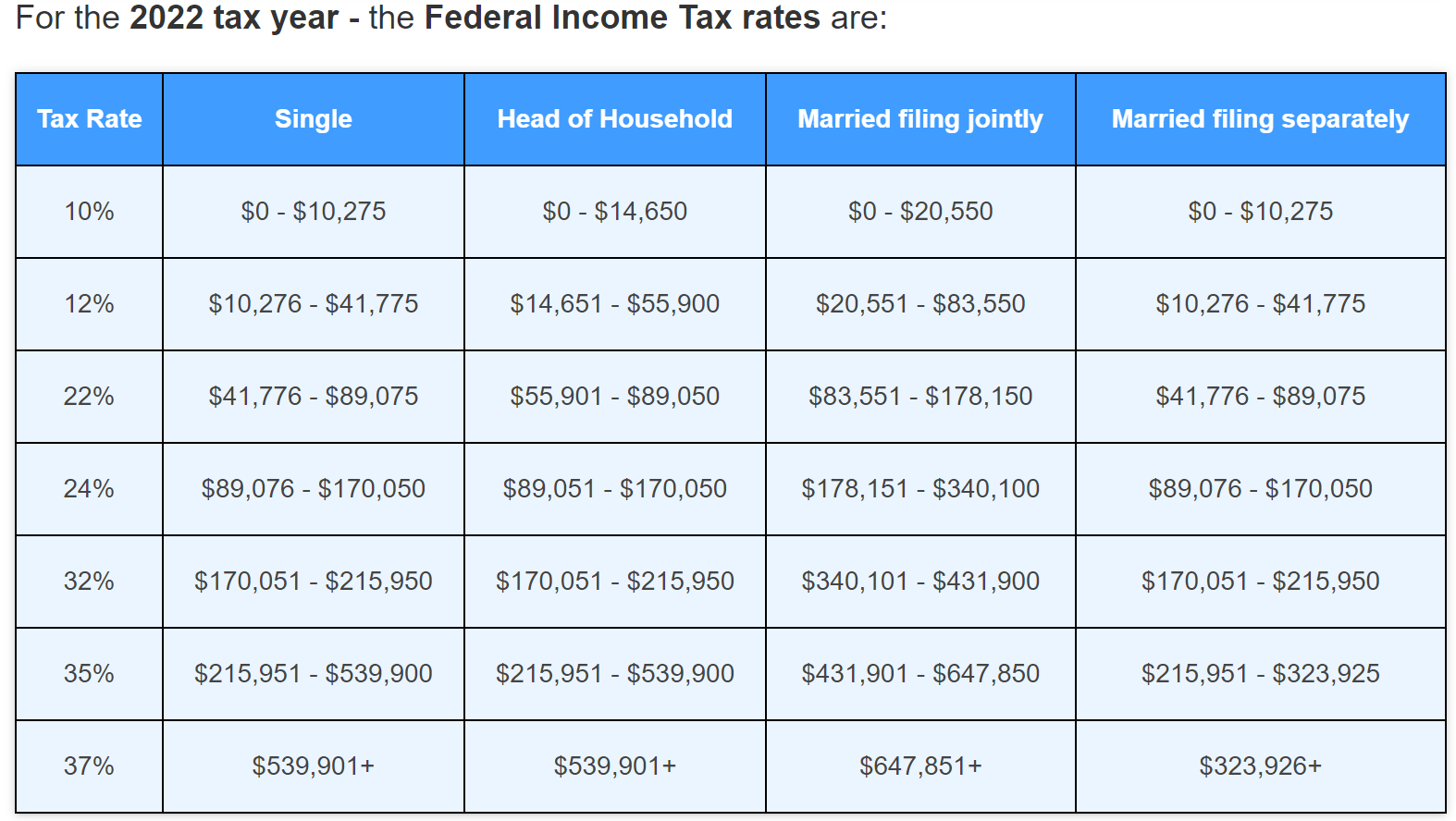

With the prices for 20491 coins and assets youll always have a complete overview. It can calculate tax incidence on crypto buying and selling transactions DeFi margin trading etc. Taxed at lower tax rates of 0 15 or 20 in the US depending on individual income over the year.

Generate a full crypto tax report with all your disposals. Koinly can generate the right crypto tax reports for you. Capital losses can be used to offset capital gains for tax purposes.

View realized and unrealized capital gains. Guaranteed to pass audits. From end-of-year tax reports to tracking your gains and losses the best crypto tax software can help you meet your goals.

3 Cointelli Cointelli is the next-generation cloud-based crypto tax preparation software developed by Mark Kang the CEOco-founder and a CPA. Tax-loss harvesting TLH is a strategy to lower current taxes paid to the US. If you realize 1500 in capital gains in a given tax year and you also realize a.

Over 75 papers on multiple crypto subjects including Tax Reporting Forks Air Drops Mining Staking and more. Content written by crypto industry experts such as CPAs.

Thoughts On Virtual Crypto Currency Taxation In The Us Advanced American Tax

Crypto Tax Unrealized Gains Explained Koinly

Understanding Crypto Taxes Coinbase

Tax Issues In The Primary Methods Of Earning Money In Cryptocurrency Part I Stephano Slack Llc

Crypto Tax Unrealized Gains Explained Koinly

.png)

The Complete Guide To Crypto Tax Loss Harvesting

How To Prepare Crypto Taxes The Checklist Zenledger

.png)

Irs Crypto Tax Deadline 2022 Tax Reporting Savings Zenledger

Crypto Tax Unrealized Gains Explained Koinly

Top 15 Crypto Tax Service Providers

Crypto Tax Unrealized Gains Explained Koinly

Vincere Tax Bummed By Crypto Losses Here Are Some Tax Tips

5 Best Cryptocurrency Portfolio Trackers To Manage Your Investments Better Thinkmaverick Best Cryptocurrency Cryptocurrency Investing

Crypto Taxes In 2021 What Should You Know By Changenow Io Medium

Crypto Tax Unrealized Gains Explained Koinly

Thoughts On Virtual Crypto Currency Taxation In The Us Advanced American Tax

Do I Have To Pay Taxes On Crypto Yes Even If You Made Less Than 600 Taxbit

Crypto And U S Income Taxes When And How Is Crypto Taxed As Income Coinbase